market shift

OCTOBER 2024 update

We never quite know what the Fall market will bring! Over the last couple of decades it has more often than not been the second busiest selling season in the inner East Bay. The weather is good, vacations are over, school is back and buyers are getting some last minute house shopping in before the holidays season takes over.

We’ve had exceptions where the market really slowed in Fall, and this is shaking out to be another.

During the financial meltdown of ‘08/09 I wrote an article about the very lengthy process of even getting into contract. We’ve had some Fall months with poor air quality from fires where no one wants to go see homes, plus the views kind of disappear!

In 2022 rising interest rates had buyers starting to get priced out and going on pause.

Having just come back from a multi-county meeting the dominant message, with some exceptions, is that the market has slowed, with increased inventory and pricing pressure.

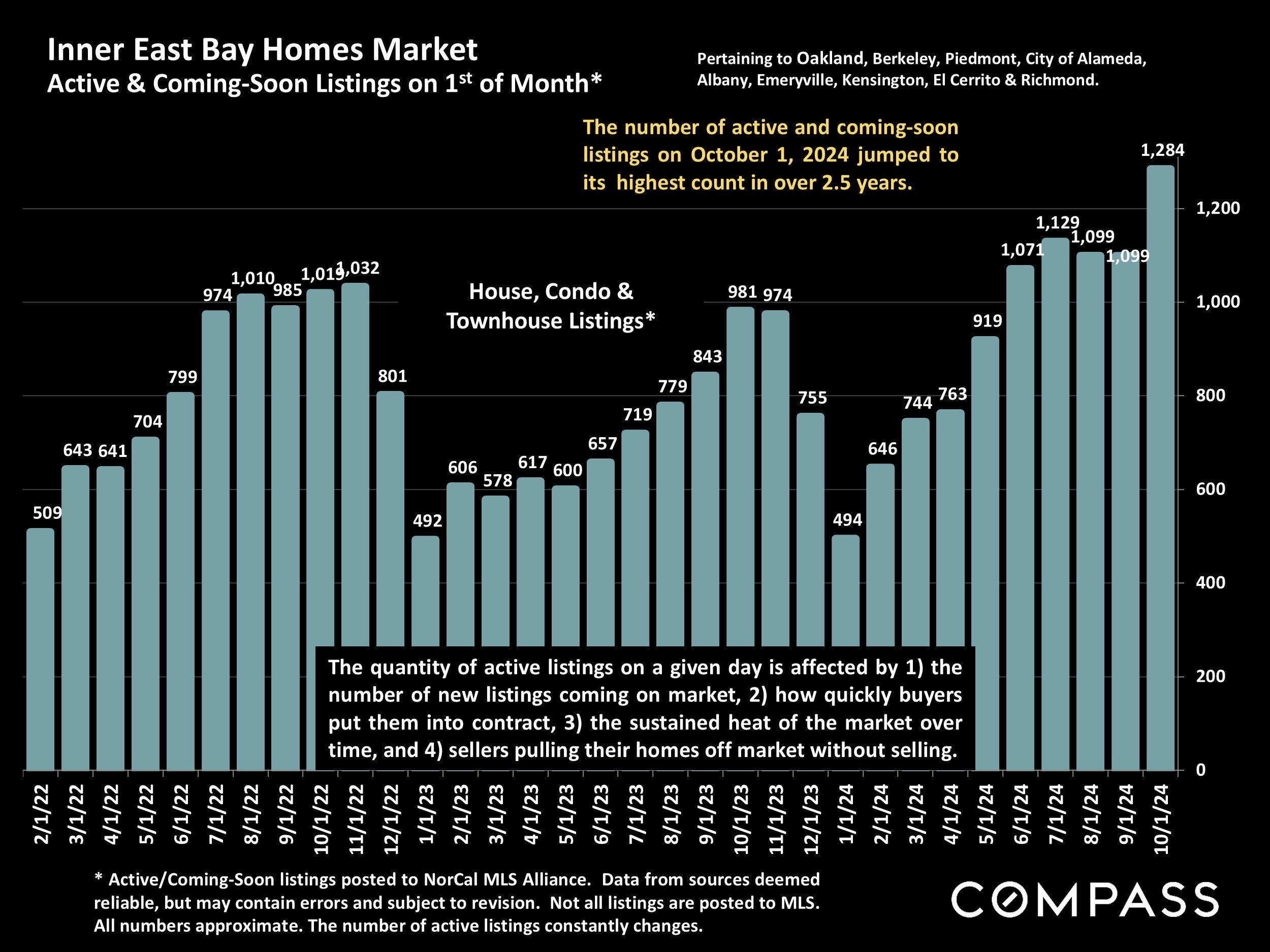

Inventory in Contra Costa, Sonoma and inner East Bay cities are at the highest levels in 2.5 years.

There is currently a significant disconnect between what many sellers feel their home is worth and what the buyers are willing to pay. It makes no sense to sellers that their value has potentially declined from what their neighbor sold for 2-3 years ago, or from what Zillow said their home was worth even early this year. Our data always lags a few steps behind sentiment, which is why listing agents get weekly calls from appraisers to help ascertain current market conditions and they focus not just on closed data but on market trends, declining or rising.

One of the most helpful ways to look at values is by considering the actual monthly costs that the buyers are facing, and how that translates into affordability and the price of a home.

Higher interest rates, insurance costs, and HOA dues for most homes mean that buyers cannot afford to pay as much for a property.

The buyer who could afford monthly payments on a $1,500,000 purchase with a mtg @ 3.5 % and home insurance of $1,500/year would now have similar payments on a $1,200,000 home with a 6.25% payment and insurance likely a minimum of $4,500/year in a higher fire zone.

There is a $300,000 affordability gap, which only goes higher on higher values homes.

Buyers’ purchasing power has dropped considerably, so yes, in theory a home would be worth more, or worth what it was a few years ago, but only if the carrying costs were on parity!

Having said inventory is higher than usual, at appx 2.5 months sell-through time, that’s still faster than a 3 month “balanced“ market (a market doesn’t favor either sellers or buyers). Interest rates are unlikely to drop dramatically anytime soon, so buyers may want to get off the fence before the Spring market when more buyers will emerge!